Insurance conditions

TRAVEL INSURANCE

FOR TOURISTS DEPARTING FROM KAZAKHSTAN (Nomad Insurance)

Mandatory Tourist Insurance Memo

Insurance compensation is paid in accordance with the coverage limit.

Insurance programs (USD 10,000 / 30,000 / 50,000) are provided in several ways:

-

reimbursement of insurance expenses after self-payment, provided that the claim was registered/approved with the Assistance company, upon return to Kazakhstan at the insurance company’s office or electronically;

-

if the insured person independently applies to clinics (medical institutions) without the involvement/approval of the insurance company, the insurer has the right to refuse coverage of part of the expenses;

-

in case the Assistance company organizes and provides guarantees to the clinic, expenses are covered within the limits of the compulsory travel insurance (CTI) program;

-

no age restrictions apply.

LIST OF DOCUMENTS CONFIRMING THE OCCURRENCE OF AN INSURANCE EVENT AND THE AMOUNT OF DAMAGE

When submitting a claim for insurance compensation, the Insured must provide the Insurer with the following documents:

1. A copy of an identity document, or the insured person’s passport with border control stamps confirming crossing of the border of the Republic of Kazakhstan and/or a document serving as the basis for the insured person’s stay in the territory of insurance coverage;

2. The original or a notarized copy of a document confirming the occurrence of the insured event and the amount of damage caused to the life and health of the insured person, including:

2.1. Medical documents indicating the address and contact details of the medical institution and physician, containing information on the date of seeking medical assistance, the insured person’s health condition at the time of seeking medical care, diagnosis, physician’s prescription (prescription), medical procedures performed, and medications provided, broken down by quantity, date, and cost;

2.2. Documents confirming payment for medical and other services provided to the insured person as a result of the insured event, indicating the amount, currency, and date of payment;

2.3. Documents confirming payment for goods and services (sales receipts, invoices, payment receipts, and other documents) indicating their name, quantity, and cost;

2.4. Medical documents confirming the fact of consumption of psychoactive substances and the state of intoxication of the insured person are provided in the event of an accident;

2.5. Documents from law enforcement, judicial, and other competent authorities confirming the fact of an accident and the circumstances of its occurrence are provided in the event of an accident;

2.6. A death certificate indicating the cause of death, a forensic medical examination report, or an autopsy report are provided in the event of the insured person’s death;

2.7. Documents confirming cancellation or exchange of travel documents (tickets, boarding passes), refusal of a reserved hotel room, as well as other tourist services provided to the insured person for the unused part of the stay abroad, are provided in cases of forced extended stay in the country (place) of temporary stay or early return to the territory of the Republic of Kazakhstan due to the occurrence of an insured event;

2.8. Travel documents (tickets, boarding passes) — in case of transportation of minor children and/or close relatives of the insured person;

2.9. Documents confirming telephone calls, messages to the insurer and the assistance company via the phone numbers indicated in the insurance certificate or insurance policy;

2.10. Documents confirming expenses related to measures taken to prevent and reduce losses;

2.11. Documents confirming the identity and rights of the beneficiary — if required.

Страхование – МСТ KZ (внутренний туризм)

Insurance coverage: up to USD 10,000

Object of insurance:

The object of insurance is the property interests of the Insured related to reimbursement of expenses incurred as a result of seeking medical services (assistance) from a medical institution while staying within the territory of the Republic of Kazakhstan, as provided for by these Rules.

Cost:

- For tourists up to 64.99 years old – USD 2 net per day

- For tourists aged 65–75 years – USD 3 net per day

Territory of insurance: Republic of Kazakhstan

Insurance coverage includes:

The Insurer reimburses expenses related to:

-

Emergency outpatient medical care, including an initial doctor’s examination, diagnostic procedures necessary to establish a diagnosis, medications prescribed by a doctor, follow-up examinations in case of deterioration of the condition, but not more than two (2) doctor visits;

-

Emergency hospitalization in a standard-type ward for no more than five (5) bed-days from the date of the insured event for the entire policy period (specialist consultations and examinations for the primary illness, emergency surgical and/or medical treatment);

-

Emergency dental care up to an amount not exceeding 15,000 (fifteen thousand) KZT for cases related to acute toothache, acute pain syndrome resulting from purulent-inflammatory diseases of the oral cavity, as well as traumatic damage due to an accident;

-

Pregnancy – in the event of unexpected complications (bleeding, etc.) requiring urgent medical intervention, with a gestational age not exceeding 12 weeks;

-

Injuries (examination, X-ray, plaster immobilization). Injuries sustained during training or competitions in professional sports are covered subject to mandatory payment of the insurance premium with consideration of the risk coefficient;

-

Transportation/evacuation expenses from the scene of the incident to a medical institution or to the nearest place where first medical aid can be provided, in cases where emergency medical assistance cannot be rendered under local conditions;

-

Repatriation expenses – the Insurer undertakes to pay for the cost of a coffin meeting transportation requirements, as well as expenses for organizing and transporting the remains to the airport closest to the intended burial place in the country where the insured previously resided.

TRAVEL INSURANCE

FOR TOURISTS DEPARTING FROM RUSSIA (IC Ingosstrakh)

Mandatory Tourist Insurance Memo (IC Ingosstrakh)

For insurance of medical expenses arising as a result of an accident or sudden illness during a trip abroad, IC Ingosstrakh organizes the provision of the necessary assistance and guarantees payment of expenses within the insurance amount established in the insurance contract.

Under insurance of medical expenses when traveling abroad, the insurer covers the following expenses:

- medical expenses, namely:

– inpatient stay and treatment in the event of emergency hospitalization, including expenses for medical services, surgical operations, diagnostic examinations, as well as payment for medications prescribed by a doctor, dressings and fixation materials (plaster, bandage);

– outpatient treatment, including expenses for medical services, diagnostic examinations, medications prescribed by a doctor, dressings and fixation materials (plaster, bandage);

– examination, emergency treatment and medications for acute inflammation of a tooth and surrounding dental tissues, as well as for dental trauma resulting from an accident.

- medical transportation expenses, namely:

– evacuation (transportation by ambulance or other means of transport) from the place of the incident to the nearest medical institution or to a nearby doctor in case of a threat to life and/or when the insured is unable to move independently due to the severity of the injury, as well as transfer to another medical institution prescribed by the attending physician and confirmed by the conclusion of the insurer’s physician or service center;

– emergency medical repatriation by appropriate means of transport, including expenses for an accompanying person (if such accompaniment is prescribed by a doctor) from abroad to the transport hub (airport, railway station, port) of the city where the insured permanently resides, or to the nearest medical institution at the place of residence (if prescribed by a doctor). These expenses are reimbursed provided that there are no possibilities in the country of temporary stay to provide the required medical assistance and/or if the insured requires a delayed (planned) operation. Expenses for emergency medical repatriation are covered within the insurance amount stipulated in the insurance contract;

– medical repatriation of the insured from abroad to the transport hub of the city where the insured permanently resides, or to the nearest medical institution at the place of residence (if prescribed by a doctor), in cases where inpatient stay expenses may exceed the limit established in the insurance contract. Medical repatriation is carried out only in the absence of medical contraindications. Expenses for medical repatriation are covered within the insurance amount stipulated in the insurance contract. At the same time, the insurer does not reimburse expenses related to medical or other assistance incurred after returning to the place of permanent residence.

- transportation expenses, namely:

– expenses of the insured for one-way travel to the country of permanent residence by economy class, if the insured’s departure did not take place on time, i.e., on the date indicated in the travel documents held by the insured, due to the occurrence of an insured event that necessitated inpatient treatment;

– one-way economy class travel expenses for children who were with the insured during the stay abroad, to the country of their permanent residence, in the event that the children were left without supervision as a result of the insured event. If necessary, the insurer organizes and pays for the accompaniment of the children;

– round-trip economy class travel expenses for one relative of the insured if the hospitalization period of the insured traveling alone exceeded 10 (ten) days. At the same time, expenses related to the relative’s stay abroad are not covered by the insurer.

- expenses for post-mortem repatriation, namely:

– expenses authorized by the service center for post-mortem repatriation of the body to the place of permanent residence of the Insured, if death occurred as a result of an insured event. Expenses for post-mortem repatriation are covered within the amount stipulated in the insurance contract.

Insurance sums for this risk range from USD/EUR 40,000 to 75,000 per insured person. The insurance sum is chosen at the discretion of the insured, taking into account the requirements of consular institutions.

What should you do if medical assistance is required during the trip?

-

Contact the Ingosstrakh service center using one of the methods specified in the insurance contract.

-

Inform the operator of:

— full name of the insured

— insurance policy number and period of validity (the operator may request a photo, scan, or electronic copy of the policy)

— location of the insured

— nature of the required assistance

— contact details for feedback

- Follow the operator’s instructions.

What should not be done?

Do not contact medical institutions without coordination with the service center. The exception is situations where emergency assistance is required.

Do not pay for medical services without coordination with the service center.

How to receive an insurance payout?

Within 30 calendar days from the date of return from the trip during which the insured event occurred, report the incident and submit the required documents:

- via the IngoMobile application

- at the nearest Ingosstrakh office

Additional documents may be sent by e-mail: tourclaims@ingos.ru.

If documents are sent by e-mail, the full set of original documents must also be submitted to the claims settlement office in your region. Please уточните with the insurance company the deadlines for doing so.

TRAVEL INSURANCE

FOR TOURISTS DEPARTING FROM UZBEKISTAN (NEO Insurance)

This medical insurance covers various illnesses and situations, including:

- Emergency medical care: treatment of acute illnesses and injuries requiring immediate medical intervention.

- Hospitalization: expenses related to hospital stay, including accommodation, treatment, and medical procedures.

- Outpatient treatment: doctor consultations, diagnostics, and treatment outside a hospital setting.

- Surgical operations: coverage of the cost of surgical interventions if the operation cannot be postponed until return to the home country (for example, appendicitis, etc.).

- Medications: expenses for medicines prescribed by a doctor.

- Ambulance services: transportation and emergency medical assistance.

- Sudden illnesses: coverage of illnesses that were not foreseeable before the trip (influenza, burns, sunstroke, etc.).

- Emergency dental care: treatment of urgent dental conditions.

The insurance also covers:

- Infectious diseases;

- Accidents and injuries;

- Chronic diseases, if their exacerbation occurred during the trip (limit EUR 700).

The insurer does not cover expenses that are directly or indirectly caused by:

- Terrorist acts (acts involving the use or threat of force or violence by any person or group acting alone or on behalf of any organization or government, motivated by political, religious, ideological, or ethnic reasons and intended to influence a government or intimidate the public or part of it), including damage caused by measures taken to prevent a terrorist act;

- Acts of war, foreign invasion, military actions (whether war is declared or not), civil war, uprisings, revolutions, riots, and civil disturbances;

- Accidents resulting from the insured person’s participation in gambling or criminal acts, as well as in fights, except for actions related to the performance of civic duty or the protection of their life, health, honor, and dignity (or those of third parties);

- Accidents occurring while the insured person was driving a vehicle under the influence of alcohol, drugs, toxic substances, or other intoxication, and/or without a valid driving license or authorization, as well as when control of a vehicle is transferred to a person in such condition and/or without the required license or authorization, regardless of the insurance program;

- The commission of an illegal act by the insured person that resulted in the insured event;

- Submission of documents containing knowingly false information regarding the insured person’s health condition or the medical and related services provided;

- Failure to submit the required documents confirming the occurrence of the insured event and the amount of losses caused;

- Other cases stipulated by the legislation of the Republic of Uzbekistan.

In accordance with these Insurance Rules, the Insurer is released from liability and does not cover indirect losses, lost profits, penalties, fines, liquidated damages, or other financial sanctions.

In the event of an insured incident

The Tourist must contact the insurance company using the contact details specified in the insurance policy. If, for any reason, the tourist paid for medical expenses independently (in the country of stay), it is necessary to:

- Retain the following documents:

- receipts and payment vouchers for medical services;

- medical report and doctor’s prescriptions;

- prescriptions for the purchase of medications.

- Submit a claim for reimbursement within 30 days from the date of return from the trip at the insurance company’s office or via the Neo Insurance mobile application.

- Attach to the claim the documents obtained from the clinic, the insurance policy, and the passport.

- The claim will be reviewed by the insurance company within 15 days from the date all the above documents are submitted.

TRAVEL INSURANCE

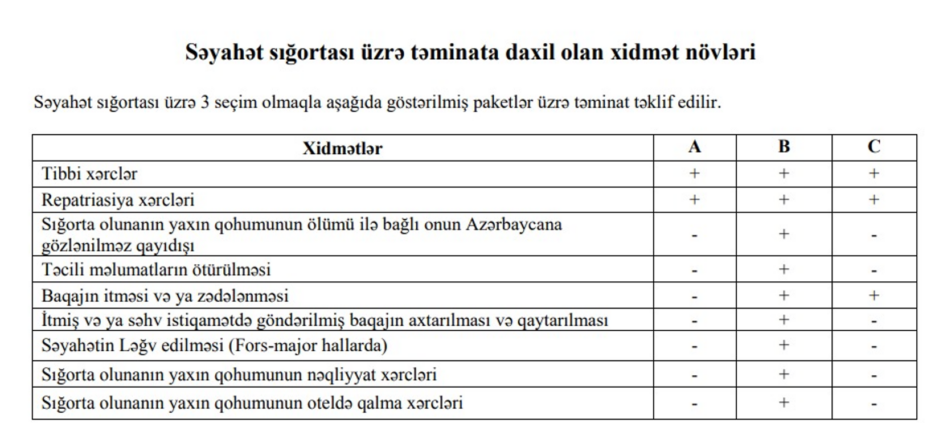

FOR TOURISTS DEPARTING FROM AZERBAIJAN

Insurance Information for Tourists Traveling from Azerbaijan

1. Medical expenses, including:

1.1. Expenses for inpatient stay and treatment provided there (in a standard-type ward); this also includes doctor examinations, surgical operations, diagnostic examinations, medications prescribed by a doctor, dressing and fixation materials (plaster, bandage, etc.);

1.2. Outpatient treatment, including doctor examinations, surgical operations, diagnostic examinations, medications prescribed by a doctor, dressing and fixation materials (plaster, bandage, etc.);

1.2.1. Medical transportation expenses, namely:

1.2.2. Evacuation of the insured person in the country of temporary stay from the place of the incident to the nearest medical institution or nearest doctor (by ambulance or other means of transport);

1.2.3. In cases where the required medical assistance cannot be provided in the country of temporary stay, emergency medical repatriation of the insured person to the nearest medical institution at the place of permanent residence, including the expenses of an accompanying person (if accompaniment is recommended by a doctor), by appropriate means of transport. Emergency medical repatriation is carried out only on the basis of documents provided by the attending physician and upon confirmation of necessity by a physician cooperating with the Insurer, and in the absence of contraindications;

1.2.4. In cases where inpatient treatment expenses exceed the insurance amount (limit) specified in the insurance contract, medical repatriation of the insured person from abroad to the place of residence or the nearest medical institution in the area of residence. Medical repatriation is carried out only in the absence of contraindications. Medical repatriation expenses are paid within the insurance amount (limit) specified in the insurance contract (insurance certificate).

2. Transportation expenses, namely:

2.1. One-way transportation expenses of the insured person to the country of permanent residence by economy class transport, in cases where due to an insured event requiring inpatient treatment the insured person is unable to travel to the country of permanent residence on the date specified in the travel documents, including expenses to reach an airport with direct international connections. The insured person must do everything possible to return the unused travel document and reimburse its cost to the Insurer. Failure to comply with this condition entitles the Insurer to deduct the cost of such documents from the payable insurance compensation;

2.2. One-way economy class transportation expenses for children (under 16 years of age) accompanying the insured person during the foreign trip who were left without supervision as a result of the insured event, to their country of residence. If required, the Insurer arranges an escort for the children and covers the associated expenses.

3. Repatriation in case of death, namely:

3.1. If the insured person dies as a result of an insured event, post-mortem repatriation expenses organized by the Assistance Company to the place of permanent residence, within the insurance amount (limit) specified in the insurance contract (insurance certificate). Funeral service expenses at the place of permanent residence are not covered by the Insurer.

4. Loss or damage of baggage

4.1. If, during planned international flights, baggage handed over to the airline (or its representative) for registered transportation is lost and not found within the period determined by the airline (minimum 21 days), the Insurer shall make an insurance payment within the insurance amount specified in the insurance certificate plan, provided that a report on the loss or theft of baggage issued by the airline is submitted to the Insurer;

4.2. The Insurer makes payment under this clause by deducting the compensation amount paid by the airline from the estimated value of the baggage, not exceeding the amount specified under the “Loss or damage of baggage” coverage in the insurance certificate;

4.3. The insured person must submit a list of the baggage contents, the estimated value, and a letter from the carrier airline indicating whether compensation has been paid for the loss or damage of the baggage;

4.4. Cash, jewelry (items made of precious metals and stones), credit cards, securities, mobile phones, audio, video, photo and computer equipment, seals (stamps) (any seals or stamps issued to or owned by or used by the insured person), personal documents and travel documents are not covered.

5. Transportation and hotel accommodation expenses of a close relative of the insured person

5.1. If the insured person’s hospital stay exceeds 7 days, the insurance coverage includes round-trip economy class transportation expenses (from the country of permanent residence to the destination and back) for one close relative and hotel accommodation expenses for up to 7 days in a hotel of no more than 4-star category.

6. Expenses related to the organization of assistance by the Emergency Assistance Center as provided for in these Rules.

6.1. The type of transport arranged for the insured person is determined by the Insurer/Assistance Company taking into account medical indications. In this case, the Insurer is not responsible for non-compliance with the transport company’s flight schedule.

7. Provision of emergency information

7.1. At the request of the insured person, the Insurer undertakes to immediately inform any person designated by the insured about the insured event that has occurred.

8. Unexpected return due to the death of a close relative of the insured person

8.1. If the insured person returns early before the end of the trip due to the death of a close relative residing in Azerbaijan, the cost of an airline ticket purchased for early return to the country is reimbursed at reasonable prices (economy class), provided that return using the original ticket is not possible. To receive compensation, after returning to the country the insured person must submit notarized copies of documents confirming the death of the close relative and the kinship.

9. Search and return of lost or misdirected baggage

9.1. In case of loss of the insured person’s baggage or its misdirection by an IATA member air carrier (or its representative), the Insurer organizes the return of such baggage to the insured person’s location in cooperation with the relevant organizations, namely airlines.

10. Trip Cancellation

10.1. If during the insurance period the trip must be cancelled as a direct result of a sudden or serious illness, accident, or death of the insured person or a close relative, or for similar reasons, the insurer ensures the return of the beneficiary to their country. The severity of the illness or accident must be assessed by a medical specialist.

Azerbaijan

Azerbaijan Vietnam

Vietnam Georgia

Georgia Egypt

Egypt Indonesia, Bali

Indonesia, Bali Kazakhstan

Kazakhstan Qatar

Qatar CRUISES

CRUISES Mauritius

Mauritius Malaysia

Malaysia Maldives

Maldives UAE

UAE Oman

Oman Seychelles Islands

Seychelles Islands Singapore

Singapore Thailand

Thailand Türkiye

Türkiye Montenegro

Montenegro Sri Lanka

Sri Lanka South Korea

South Korea